Banks across the Philippines are gearing up to implement a new check format, effective May 1, as announced by the Philippine Clearing House Corporation (PCHC). This initiative, initially slated for May 2, 2023, has been rescheduled and will now come into effect this year. The transition marks a significant step towards modernizing the country’s financial infrastructure and streamlining banking processes.

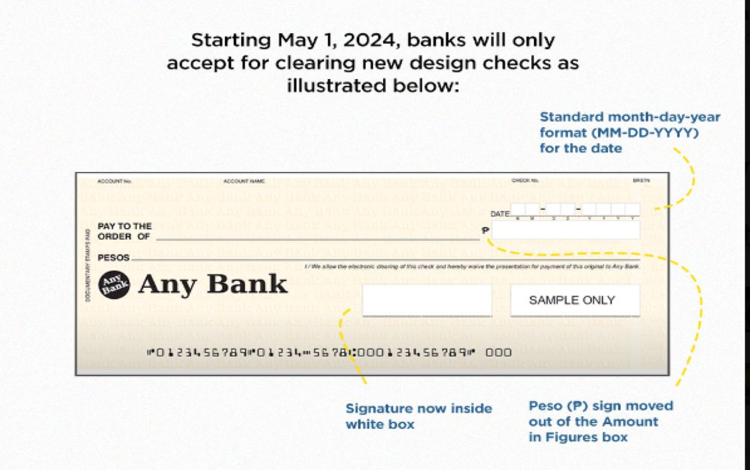

Among the notable changes in the new check design is the adoption of a standardized date format, utilizing the month-day-year numerical configuration. This adjustment aims to enhance clarity and consistency in date notation, simplifying transaction records for both banks and customers.

In addition to the revised date format, the updated check design incorporates several key features. Notably, the Philippine Peso sign will now be positioned outside the numerical amount panel, ensuring greater prominence and visual distinction. Moreover, a designated box for signatures has been introduced, facilitating smoother verification processes and minimizing the risk of unauthorized alterations.

Individuals and businesses must familiarize themselves with these modifications to avoid any disruptions in banking transactions. With the deadline fast approaching, customers are encouraged to ensure compliance with the new check format to prevent any inconvenience in financial dealings.

As part of the transition process, banks will continue to accept checks featuring the old design until April 30, 2024. However, it is crucial to note that checks not converted to the new format or those written in alphanumeric form will only be accepted if dated on or before April 30, 2024. Furthermore, these checks must be presented for deposit within 180 days from the date of issuance to be eligible for processing.

While the introduction of the new check format represents a significant change, it is ultimately aimed at improving efficiency, security, and standardization within the banking sector. By embracing these enhancements, both banks and customers stand to benefit from a more streamlined and secure financial environment.

In light of these developments, stakeholders are encouraged to stay updated on any further announcements or guidelines issued by regulatory authorities. Clear communication and proactive preparation will be essential in navigating the transition smoothly and ensuring continued seamless banking operations.

As the May 1 deadline approaches, stakeholders are advised to take the necessary steps to adopt the new check format and adhere to the prescribed guidelines. Through cooperation and adherence to best practices, the Philippines banking sector can successfully usher in this era of enhanced efficiency and security in financial transactions.